The First Cut is the Cheapest

By Lionesses of Africa Operations Dept

Every so often we come across real life practical issues amongst our Lionesses and even from outside of our inspirational membership as we talk, mentor and occasionally consult to these companies. Sharing the issues and the practical solutions we find, helps others who are in the same position. Obviously no names will be mentioned, but these are all generic problems that can potentially hit us all and from the experiences of others, we all can learn.

So – ever tried to buy a product that is usually in stock at your usual suppliers, yet wherever you go, even to new suppliers, you are constantly told the product is out of stock? And for the subject of our letter today, what happens when (just as in the children’s game ‘Musical Chairs’) desperate for the product you pay far above the usual price. As your supply finally arrives, you realize the bottleneck has evaporated and those who waited rather than chased the market are now being supplied as normal, at a lower price and are sitting safe and smug on their chairs while you flounder around. Now your product is significantly more expensive than your competitors’…

Today, we look back at our economics lessons from school and at Supply and Demand Charts! For those of us who sat at the back and snoozed during these lessons, the chart is our title photo this week and was created by the brilliant Chris Makler from his website https://www.econgraphs.org/ perfect for economic’s nerds such as our HoF.

Take a moment to play with this graph here. {What you will see are some buttons to the right, before you do anything – under ‘Options’ tick the box to ‘Set price to equilibrium’. and you are ready to go!}

Following our incredible Changing Face of Women’s Entrepreneurship in Africa Conference in partnership with Harvard, (here) we touched on an issue that we warned was going to be a problem, and indeed it turned out to be. We are talking of PPE, yes, the masks we all love to hate.

As we wrote at the time (here):

“…When CV19 struck all PPE gravitated to the huge western countries, if you were a long standing customer of one of these factories trying to source PPE during that time, sorry for you!…..You may have pivoted into making PPE recently, but you know that soon there will be a glut and all the western and Chinese manufacturers will once again look to Africa to dump.”

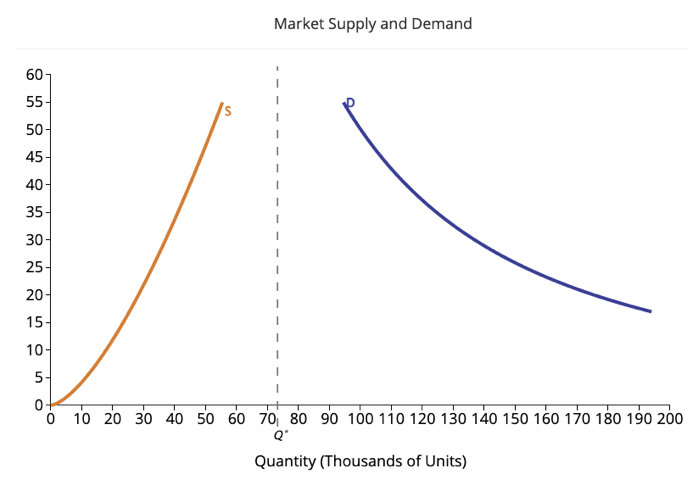

…and indeed PPE has popped up recently in one of our discussions with a major supplier to the UK industry in quality PPE, who woke one morning to find that their own suppliers were talking calls from major Presidents and PMs of the world wanting to corner the market in masks, at the same time as their own calls were going unanswered… Looking to our trusty Supply and Demand chart, with Supply (Orange) collapsing and Demand (Blue) souring, the volcano exploded and the Price shot skyward, like this:

If you could see where the price was, that alone was a miracle!

“We need supply – Buy at any price!” was the plea from their salespeople – so they did.

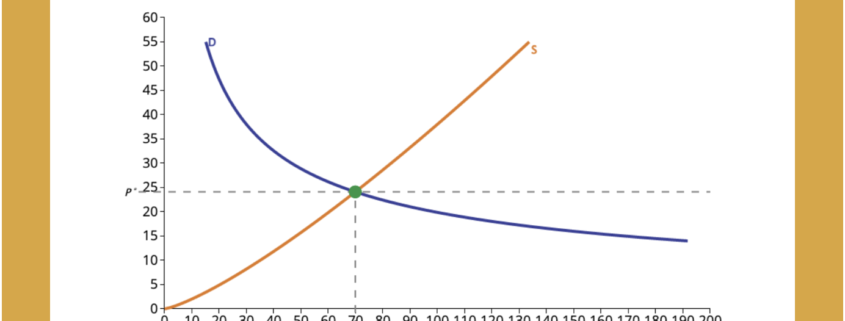

The day that they finally received supply, it was as if the dam had burst, China was back on line, customers were happily using lower quality products and the price collapsed as you see here:

Now it becomes interesting – what to do with the quality masks that cost so much more than normal? 80,000 of them… Yes – Ouch!

Many people fall into the trap of keeping onto the product hoping that either the supply disappears again or demand soars, or that they will slowly be able to sell these quietly over time, but this is an error. The market price is now significantly lower, all competitors are stocking up (also – just in case), so all you will manage to do is lock up cash in a wasting asset. You might argue that a mask is a mask is a mask and certainly not time sensitive such as milk. But these masks are taking up warehouse space, are creating a situation where everyone in the company is talking about them and although trying to find solutions, are not concentrating on their day job. Most importantly, your cash is tied up, which even if you did not eat into your overdraft to pay for this, cash has a cost that must always be considered by any business. Cash that is tied up for months, if not years, and importantly, is not being used to generate profits elsewhere.

Cash needs to be exercised. This is why PE Firms when they buy into your company do not want you to buy a Lamborghini or increase your salary – they want, expect and indeed demand that you put their cash to work. Like a great athlete where fitness comes from exercise, you have to get that cash running around and around the track, not sitting in the locker room chatting and eating Doughnuts.

So rule 1: Rescue the cash and get it working again!

Next rule: You have to stop thinking of this in price terms. “I bought at 100, I can’t sell at 45!!” If you do that someone else will nip in to sell at 45 and so you will then be looking at 40 or 35 as the next best price. This is the problem with which Surgeons daily deal. Do you sacrifice the infected arm to save the body or try to save the arm and watch in horror as the infection spreads into the heart and lungs? You have to make fast and often drastic decisions in these situations.

In our PPE story, there is a chance of losing your company (the body) if your cash is tied up, unable to move, and you have bills to pay. You know where the factory price is now, so that gives you a base – sadly it also tells you where others can sell if needed as well. The longer you wait in those situations, the more painful it will be. You made the mistake – own it.

So what in our Crystal Ball can we see ahead? Plastic is the next big thing as we said here back in March. Everyone is talking about Inflation as demand sours as we head out from our Covid Cocoons, but is it inflation, a souring demand, or is it simply the fact that supply died and so prices rose? “The freeze in Texas, which is one of largest exporters of plastics and other petrochemical products, caused production of 75% of polyethylene, 62% of polypropylene, and 57% of PVC to shut…Re-opening the plants, the Journal noted, is a painstaking and dangerous process that takes more than the flip of a switch.” (here). What will happen when that supply finally springs back into action? Could we see a copy of what happened when the PPE manufacturers turned their machines back on?

Once again, making no apologies for the kind of reading material that excites the HoF, here is the latest from ‘Plastics Today’ here.

“Processors began to believe that the May $0.05 to 0.06/lb increase could be viable and became more aggressive with their purchases. Buy orders streamed in at a quicker pace. As offers were scooped up, spot prices rose a few cents more, writes the PlasticsExchange. Most producers are still in force majeure with limited allocations of resin for contract buyers. Buyers also started to look for larger volumes of material that would sustain them for longer periods, namely through June.” (beginning to sound a bit like the PPE panic buying!).

Please be fully aware, we have no idea what we would have done during the PPE panic where supplies disappeared faster than a cup of hot coffee in front of the HoF. Would we too have succumbed to the begging of the sales team? Who knows! We like to think we would have held back – but hindsight is always correct with 20/20 vision. We also have no idea if Plastics will drop in price once the supply comes back on… Perhaps inflation will run rampant. Who knows!?

But it is true that the current Plastics move coupled with increased shipping pricing (due to ships and containers in wrong ports as we discussed here) are causing serious headaches across the world. We simply ask that you consider in all your actions, your exit (when you are going to sell). There are reasons why the great investors ask time and time again when considering an investment – what is the exit strategy? In our situation, if buying at the much larger price ensure you have ready buyers for when the 40 foot container arrives or that your production team is ready to move fast to get your own product out the door and quickly into shops.

Just remember, you don’t have to be clever to buy a product, it’s the selling that is the difficult part, and those who wait until the music stops will find it’s very lonely.

Stay safe.

Leave a Reply

Want to join the discussion?Feel free to contribute!