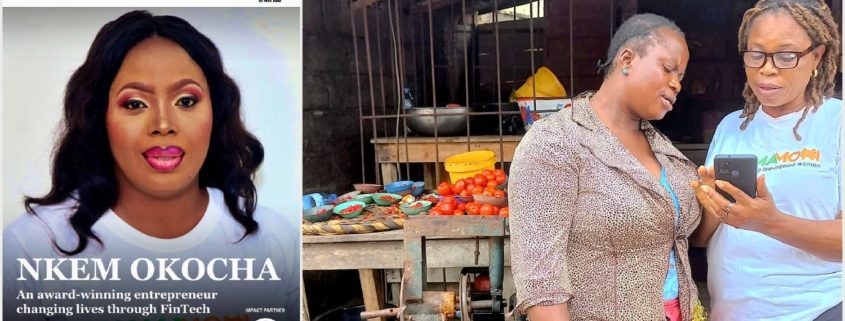

Nkem Okocha, an award-winning entrepreneur changing lives through FinTech — Lionesses of Africa

Mamamoni, a Nigerian FinTech social enterprise empowering low-income women with skills and small loans

Nkem Okocha is a serial award-winning social entrepreneur and the founder of Mamamoni in Nigeria, a FinTech social enterprise that empowers low-income rural-and-urban slum women with free vocational and financial skills, and small loans. She is passionate about the change that is possible from investing in poor women in underserved communities. Nkem’s vision is guided by the saying that, “No woman chooses to be poor, but we can choose to help poor women by investing in them”. Mamamoni has impacted over 10,000 low-income women in Nigeria, and she has won many awards, local and international, for her work with women. Nkem is a 2015 Tony Elumelu Foundation Alumna, 2016 outstanding LEAP Africa Social Innovator, Young African Leadership Initiative (YALI) alumna, GSBI® accelerator Alumna and a 2017 Mandela Washington Fellow, A 2020 Innovative Justice Accelerator fellow and She is passionate about Women Empowerment, Financial Inclusion, Technology and Entrepreneurship.

LoA spoke to the inspirational and impact-driven Nkem Okocha this month to learn more about what drives her to positively change the lives of low-income women in Nigeria.

What does your company do?

Micro Lending by MamaMoni www.mamamoni.com.ng aims to provide micro business loans to underserved women and low-income women in rural and urban areas in Nigeria. We cater to those women who ordinarily cannot be captured by the formal credit system. We offer them fast and simple loans that enable them to build, grow and sustain their businesses.

What inspired you to start your company?

I started Mamamoni due to the experience I had as a child – we lost our father, and my mother was a full-time housewife, with no livelihood skill and no finance to start a business. Feeding and education was a big challenge, and I had to hawk shampoo in major markets in Lagos Nigeria and later became a house help. Later in life, after resigning from my banking job after 8 years and started running my small business, I discovered we had a lot of idle women in my community and other communities I visited. I found that they had no livelihood skills and they had no money to start businesses, and as a result, they remained poor and unable to afford to feed or educate their children. In 2013, I started empowering women from different backgrounds on a range of vocational skills to help them start their own business and in 2014 we started the financial loans part of our business.

Why should anyone use your service or product?

We support our customers with digital skills, financial literacy, skill-based and business training through our Shesabi App (available on Play store) or offline training for those without smartphones to access the Shesabi App and website. ( www.shesabi.com)

Our App Micro lending by Mamamoni which is a Progressive Web Application (PWA) and Android App is the first lending app in Nigeria built for women only, also our PWA version enables low-income female entrepreneurs with low-end smart phones to access our loans.

Tell us a little about your team

As the founder, I lead the team of 10 at Mamamoni. Our team consists of individuals who are passionate about using innovation to uplift and empower low-income women in Africa, I have 8 years’ experience in the banking sector, 5 in the mobile money space, and 8 years working with low-income women in different communities. We have a board of advisors with over 40 years’ experience in the Tech and Financial Sectors.

Share a little about your entrepreneurial journey. And do you come from an entrepreneurial background?

I have 8 years banking experience in operations and marketing. I am so passionate about entrepreneurship, so while working in the corporate world, I had a business where I sold motivational, Christian, and inspirational books. I also had a book club where people used to come and rent novels for a fee. After resigning from my job, I knew I wanted to positively impact the lives of other women, due to my own personal experience and the level of poverty in my community – these factors led to the founding of Mamamoni.

What are your future plans and aspirations for your company?

Our main objective is to empower and provide access to finance for women who are not in an economic position to secure funding from traditional financial institutions because of certain barriers like collateral, transaction history, and also to drive innovation through leveraging mobile and web technology. With our newly launched lending application we hope to fund 1,000,000 low-income entrepreneurs in the next 5 years.

What gives you the most satisfaction being an entrepreneur?

I get satisfaction when I see the transformation in the lives of the women we have empowered. Due to our interventions and innovations, they now have skills to help them generate income to feed their family, educate their children, etc. Also, they now have easy access to capital to start, grow and scale their small businesses.

What’s the biggest piece of advice you can give to other women looking to start-up?

Start with what you have (skills, expertise, goodwill, social capital, etc.) and don’t wait until you have secured millions to start-up.

Let your venture not be for profit only, let it have social impact in your communities.

Be focused, persistent, disciplined, diligent and hard-working.

To learn more about Nkem and the story of Mamamoni, connect with her on LinkedIn https://www.linkedin.com/in/okochankem/ or via email: okocha.nkem@mamamoni.org

Also, follow Nkem and the work of Mamamoni on their website and social media platforms:

Leave a Reply

Want to join the discussion?Feel free to contribute!